Jeff Brown teases 3 different investment chances, the very first of which is simply purchasing AMZN ... not a backdoor chance, but the other 2 are ... Purchase Amazon (AMZN) They both are actually hardware companies from the sounds of it, but obviously he does not provide us the names of companies # 2 and # 3.

Brown said that "this business would be the leading tech stock of 2016" In the early days they were "mostly a video gaming company" And we were told that this is the very same company that makes the sophisticated hardware for Google's And Microsoft's cloud computing services. So ... very little to go off of here, however thankfully just enough for me to piece together this puzzle.

Nvidia is a GPU (graphics processing unit) manufacturer that started making these processors for gaming gadgets, and has because expanded into professional markets. Their "chips" are now used in whatever from video gaming consoles, to self-driving jeff brown 6g stock pick lorries, to AWS's services and far more. All of the ideas compare well, however what actually offered this away was when he specified it was his leading tech pick of 2016, which I found out it was after doing some digging around.

We're told that it ..." is producing the bulk of these processors for AWS"" In the fourth quarter of 2019, sales were over $2 billion" When Brown states that it makes "processors" for AWS, it's difficult to know exactly what he implies by this. After all, Amazon itself is currently custom-made building their own " Graviton" processors, but they also utilize Intel and AMD processors for their EC2 services.

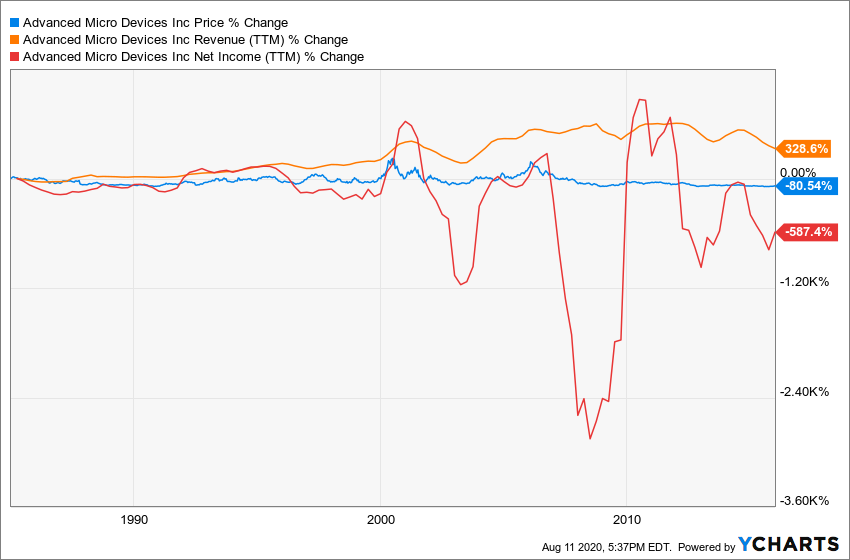

However, it appears that AMD is a quite excellent match. As pointed out, AMD does supply processors to AWS for some of their services, and it was likewise mentioned that this company's sales were over $2 billion in the fourth quarter of 2019. Well, AMD's 2019 4th quarter sales were reported at $2.

AMD is in fact a rival to Nvidia, making GPUs and CPUs, with some https://manueleazk254.over-blog.com/2021/03/jeff-brown-beyond-exponential-event-jeff-brown-reveals-no.html of their items known for their high memory clockspeeds. Is it AMD? This one I'm not favorable on.

I have actually gotten a great deal of questions in the past couple days about Jeff Brown's "Pre-IPO Code" presentation, in which he teases the concept of this "Pre-IPO" investing method as he pitches his brand-new Blank Examine Speculator newsletter. And I have actually got excellent news and problem. Fortunately is, I can explain what he's talking [] "Upgrade" newsletter from Brownstone, launched early in 2021 and intending to advise a dozen or two Special Function Acquisition Corporations (SPACs) annually, most likely pre-deal SPACs that have not yet announced a merger target.

The ad is everything about the potential gains being driven by "Job Xi" so what's the huge idea, and which stocks are getting the teaser treatment here? [] Definitely all the investment newsletters have actually been a-titter over the fortunes to be made with 5G however now Jeff Brown is upping the ante a bit with his teased bet on 6G, which certainly stood out of many a Gumshoe reader in current days.

I wonder if KODK was on that list https://secure. brownstoneresearch.com/?cid=MKT473114&eid=MKT480065&encryptedSnaid=U7P5FTBSsBnQnHMooXNtPNuV%2Fne6zeBBvdL0kRwDTGE%3D&snaid=SAC0018220991&step=start&emailjobid=4757811&emailname=200729-BR-Paid-BST-Buy-Alert-PM-Ded&assetId=AST142784&page=2 Hypes Amazon Web Solutions// AWS however says the backdoor play is 2 advanced hardwire producers concentrated on AI/ Edge Computing/ Storage Processors. Looking for clues to the teaser stocks. Boston biotech and an antibiotic. Apparently skipping over phase 2 screening to stage 3.